Maynilad to sell P15-B of ‘Blue Bonds’ to fund capex projects ahead of IPO

Maynilad Water Services [link], a subsidiary of Metro Pacific Investments (MPI) and an affiliate of DMCI Holdings [DMC 12.30, up 0.2%], disclosed its application to the SEC to sell up to P15 billion worth of fixed-rate “Blue Bonds” in the last week of May, for listing on PDEx in the first week of June. According to Maynilad, this offering is […]

Maynilad Water Services [link], a subsidiary of Metro Pacific Investments (MPI) and an affiliate of DMCI Holdings [DMC 12.30, up 0.2%], disclosed its application to the SEC to sell up to P15 billion worth of fixed-rate “Blue Bonds” in the last week of May, for listing on PDEx in the first week of June. According to Maynilad, this offering is “the first PHP-denominated fixed-rate Blue Bond to be registered with the SEC”. Blue Bonds are functionally the same as regular bonds, except that the proceeds may only be used on projects that “substantially contribute” to objectives under the United Nations Sustainable Development Goals, like a reduction in greenhouse gas emissions, water savings, reduced waste, or wastewater treatment.

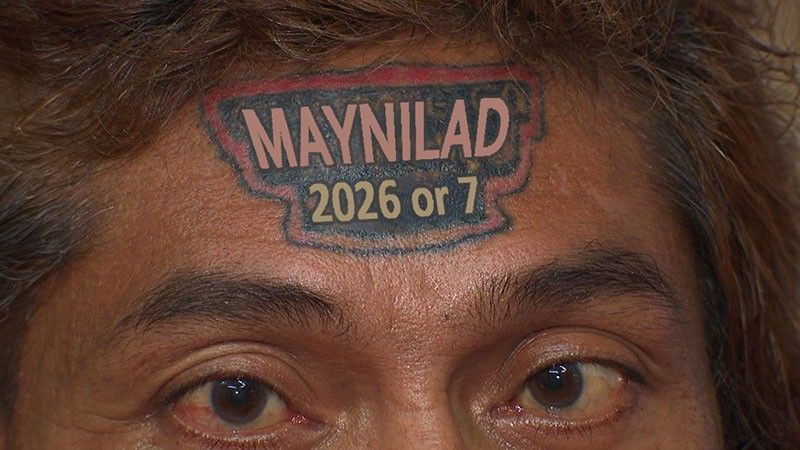

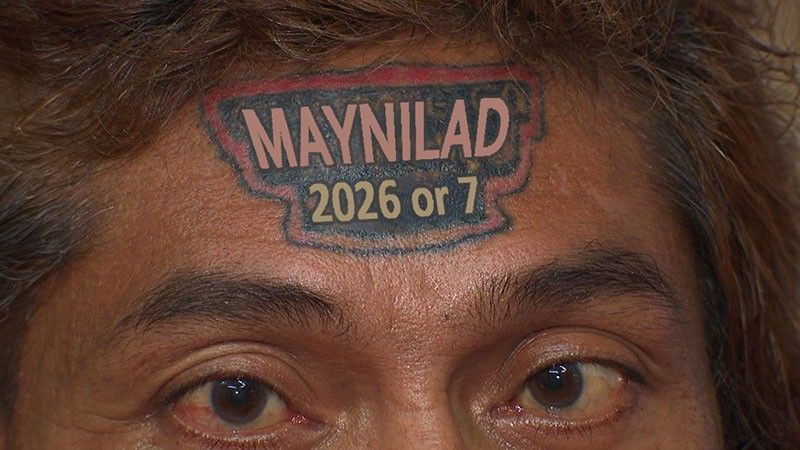

MB bottom-line: MPI has been slow-walking a Maynilad IPO for years. The IPO is required as part of Maynilad’s concession agreement, and the deadline for the IPO was extended from 2021 to January 2027 as part of the revised franchise granted by Congress. The company has set a rather loose timeline for the IPO (sometime in 2025 or 2026), and seems like it’s doing whatever it can to fluff its valuation ahead of the mandated sale of at least 30% of its outstanding shares in that eventual IPO.

—

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.