FILRT’s FY23 performance is down across all major metrics

Merkado Barkada February 28, 2024 | 8:00am Filinvest REIT [FILRT 3.09, down 4.3%] [link] put out a press release to accompany the dividend that it declared on Monday, and I found a few things interesting when I compared this PR to the one they released last year around the same time [link]. The first is that […]

Merkado Barkada

February 28, 2024 | 8:00am

Filinvest REIT [FILRT 3.09, down 4.3%] [link] put out a press release to accompany the dividend that it declared on Monday, and I found a few things interesting when I compared this PR to the one they released last year around the same time [link]. The first is that FILRT’s FY23 performance was worse than FY22 across every major metric that we track for REITs; net income was down 2.2% to P1.28 billion; total revenues were down 7.4% to P3.0 billion; occupancy was down from 89% in FY22 to 83% in FY23; tenant retention was down from 96% in FY22 to 77% in FY23; and WALE was flat at 6.9 years, despite cheesing the figure with the inclusion of the Boracay lot with the 40-year lease. The second thing that I noticed was that FILRT’s press release didn’t mention that any of the statistics I just listed were lower than the previous year. The only time FILRT even refers to FY22 is in the discussion about the amount of GLA covered by new leases; FILRT signed 5,087 sqm of new leases in FY22, but 20,139 sqm of new leases in FY23, which FILRT describes as “almost a fourfold improvement from [FY22].” The third thing odd to me was that FILRT referred to its WALE as “improved significantly” and that including the Crimson Boracay lease “pushed the WALE to 6.91 years.” Unfortunately, upon checking FILRT’s FY22 Annual Report, I found FILRT saying on page 47 that it had a “[WALE] of 6.9 years as of end-2022.”

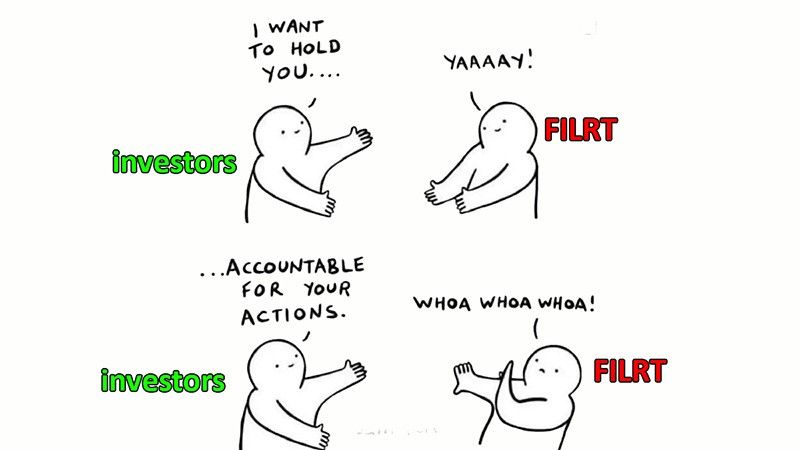

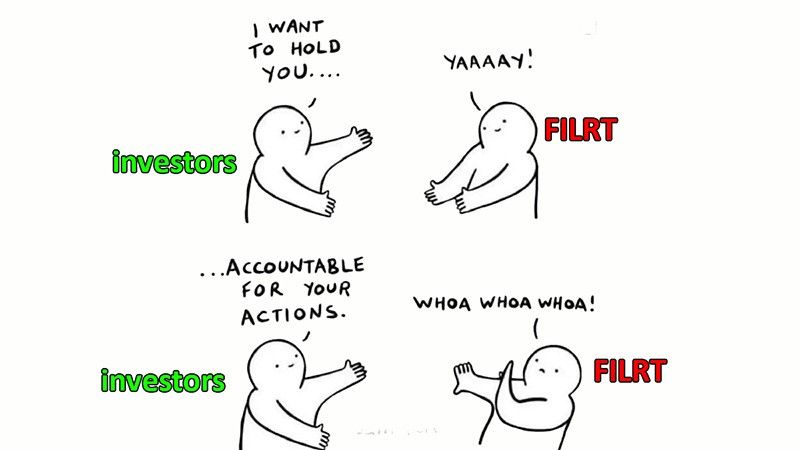

MB bottom-line: Where’s the accountability? Given the massive changes that are happening in the commercial office space, I’m willing to accept that times have been challenging for our REITs, and I’m even willing to accept that FILRT could have been caught with its pants down (reasonably, through no fault of its own) by those changes. But when the management team gaslights and deflects like this I just can’t give the company that benefit of the doubt. I think the approach of this press release is harmful to the health of our market. It doesn’t try to frame FILRT’s poor performance with additional context that investors might find helpful; instead, it does everything possible to ignore the falling numbers and pretend as though the Q4 dividend hasn’t fallen 42% from what it was back in Q4/22 or that the stock price hasn’t fallen 54% from its 2021 IPO. One could imagine an investor reading this statement and coming away from it thinking that things were, in fact, going better than ever and that the current management team has delivered nothing but success after success to its board and shareholders. That’s not what PR should be, and Merkado Barkada exists (at least in part) to help investors see past these old-timey tactics.

–

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.